Pre requisite

Beofre starting the setups in e business TAX, one needs to check if the following setups are complete or not

1. Geography structure of the country

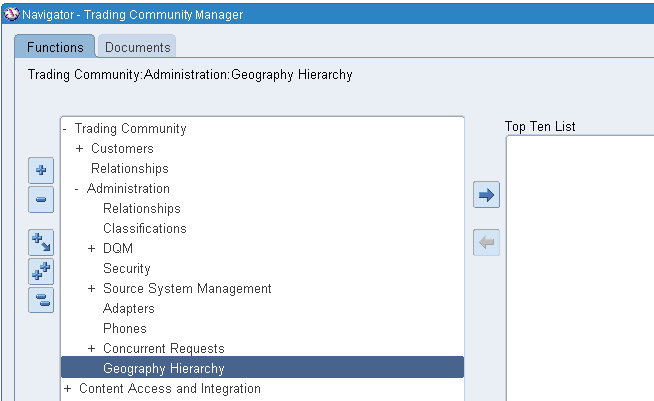

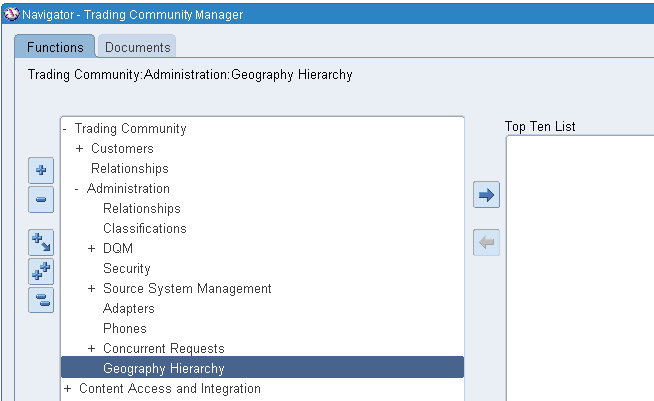

Navigate to

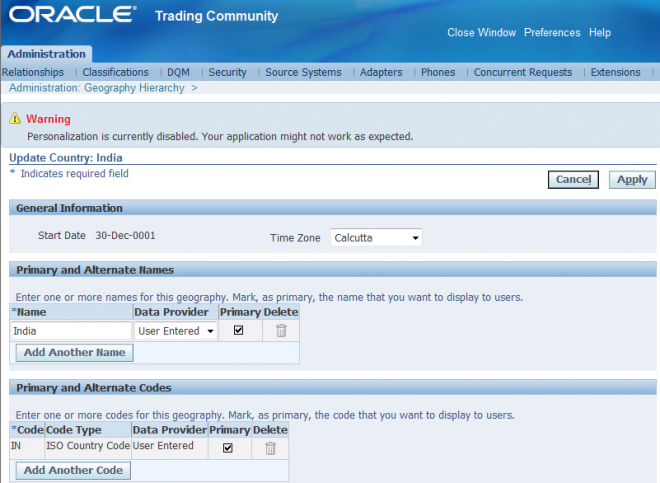

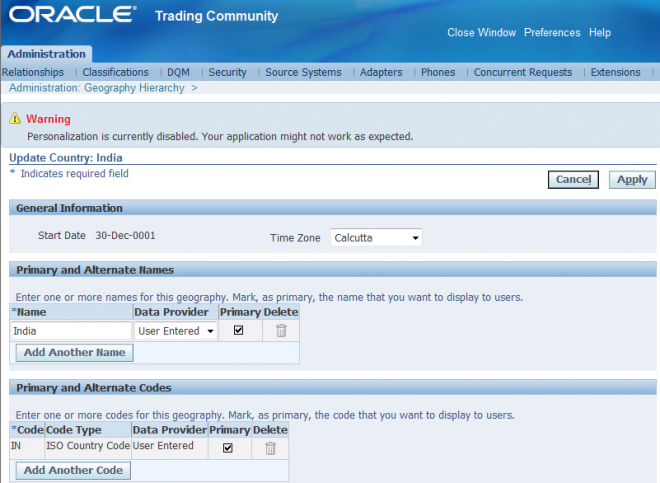

Define the geograpy hierarchy

Beofre starting the setups in e business TAX, one needs to check if the following setups are complete or not

1. Geography structure of the country

Navigate to

Define the geograpy hierarchy

A recoverable tax is a tax that allows full or partial recovery of taxes paid on purchases, either as a recoverable payment or as an offset against taxes owed. Also known as "Input Tax Credits" this tax is normally recovered because it was paid on an item that will be used in creating another item sold to an end user.

There are usually many regulations surrounding the details of tax recovery. Typically only a portion of the tax amount paid is recoverable, and tax authorities designate the tax recovery rates that indicate the extent of recovery for a specific tax. As with all tax setup, consult your tax department or a tax professional to determine how you should configure your system.

Some Examples:

1. 100% Recovery Tax: Most VAT-type taxes allow for full recovery of taxes paid on goods and services that relate to taxable business supplies.

2. Partial Recovery Tax: In cases where an organization purchases both taxable and exempt supplies, the tax authority can designate a partial recovery rate to reflect the combination of taxable and exempt statuses.

Prior to release 12, tax was defined in Accounts Payables module. A tax component on the document total could be associated with the purchasing documents for portion of the tax which was non recoverable. Purchasing would default taxes based on hierarchy defined either in Oracle Payables (Setup > Options > Payables > Tax code defaults) or in Oracle Purchasing (Setup > Organization > Purchasing Options > Tax Default Alternate Region) if "Enforce Tax From Purchase Order" box in Payable Options (Setup > Options > Payables > Tax code defaults) was checked.

Taxes were associated with rates, non-recoverable ratio and recovery rules. Taxes were then defined in at least one of the levels (also called the tax source) for e.g. Item, Supplier, Supplier Site, and Location etc. The order of defaulting was decided by the hierarchy defined in the Payables/Purchasing options discussed previously. Tax calculation was called on a Requisition/ Standard Purchase order or a Blanket release based on the hierarchy, recovery rules and rates. Tax calculation is performed using the AP Tax Engine, which was called from the distribution, or PO/Requisition. Once the tax is defaulted and saved tax cannot be redefaulted even on changing the tax source in the document.

It was possible to override the tax defaulted on Purchasing documents prior to receipt or prior to reservation on funds on the document incase of encumbrance accounting. To override tax we need to have the profile option Tax: Allow

Override of Tax Code set to Yes. Profile "Tax: Allow Override of Recovery Rate" allows override of recovery rate if the values of this profile is set to "Yes".

Due to complexity of the tax specifications based on country/product, Oracle used to provide certain country/product specific solutions for diverse tax related requirements. (For e.g. Latin Tax Engine in GTE, Brazil AP/PO Tax Engine, India R11i localizations).

E-business tax

E-business tax design was completely new for release 12. Most of the features available in 11i have been accommodated in release 12 e-business tax. Following are some of the features that will not be available in release 12 e-business tax as compared the 11i features:

1. Tax Code is removed from the ‘Enter Purchase Order’ form. Instead tax classification field will be available in tax page available through ‘Manage Tax’ link. Users can no longer make a purchase order shipment nontaxable

by removing the tax code from the PO shipment.

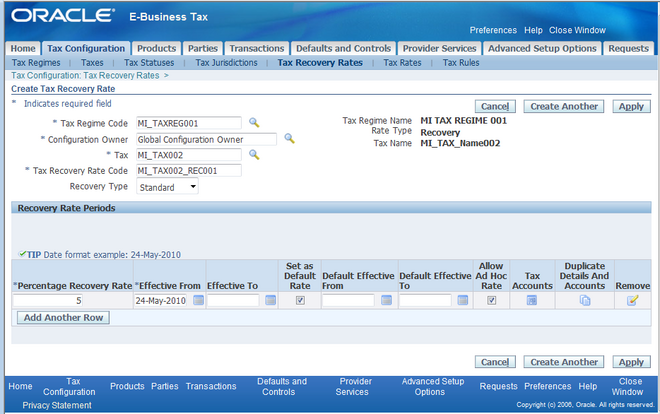

2. Recovery Rate field at the distributions level will no longer be defaulted based on the Tax Code and will no longer display the default recovery rate of the transaction. Override of recovery rate will be subject to controls setup within e-business tax.

3. User updated Tax Code on the requisition lines will no longer be carried over to the PO document during autocreate. The Tax Classification will always be re-defaulted on the PO document.

4. Summarized tax information on purchase order has been eliminated. Only detailed tax line can be viewed on the purchase order.

5. Tax Code cannot be populated through the purchase order Preferences form.

6. Tax cannot be modified through AutoCreate requisition 'Modify' action, as the tax is re-defaulted on the PO regardless of the tax in the requisition.

7. Detailed tax information based on tax classification will not be available in the requisition. For requisitions, users will only be able to view the tax amounts (total, recoverable and non-recoverable).

8. Tax code has been removed from RFQs and Quotations form. Tax will be defaulted when a quotation is autocreated to a standard purchase order.

9. PO documents cannot be reserved or submitted for approval if tax calculation error has occurred.

10. While importing documents in the interface with Authorization status ‘Approved’ using PDOI, a tax calculation error will result in creation of a document with ‘Incomplete’ status or in updating of an already ‘Approved’ document to ‘Requires Reapproval’ status, if the ‘Initiate Approval’ parameter was set to ‘Yes’.

11. Tax calculation error in Requisition Import will create imported requisitions with interface authorization status in ‘Approved’ status as ‘Incomplete’.

12. Withholding tax will no longer be supported. Withholding Tax does not affect any taxes that organizations owe the tax authority, so there is no significance to the organization’s accounts/budgeting. It serves more as a way to direct payment of portion of the taxes already owed.