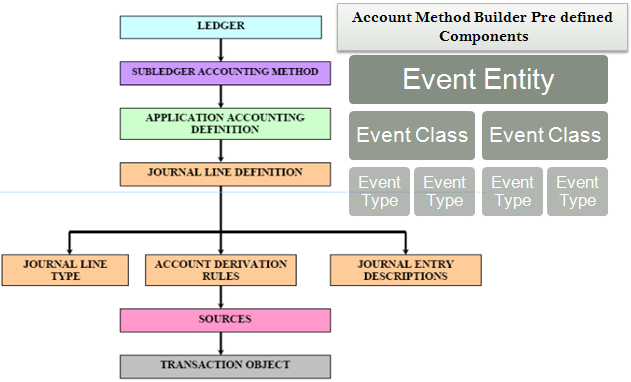

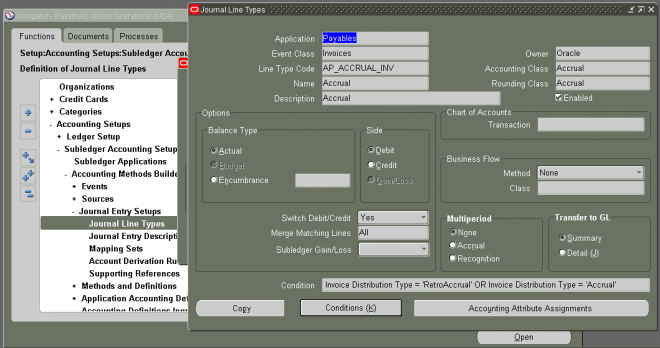

Journal Line Type

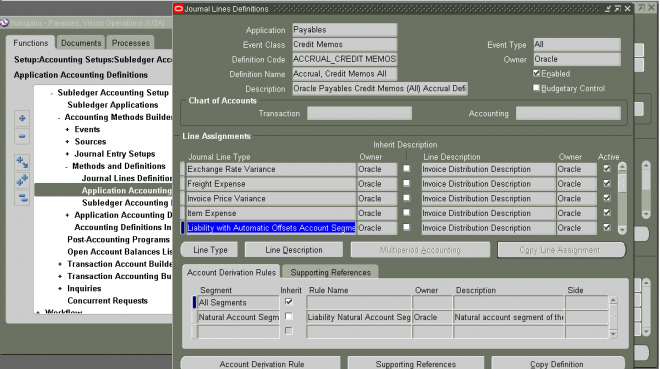

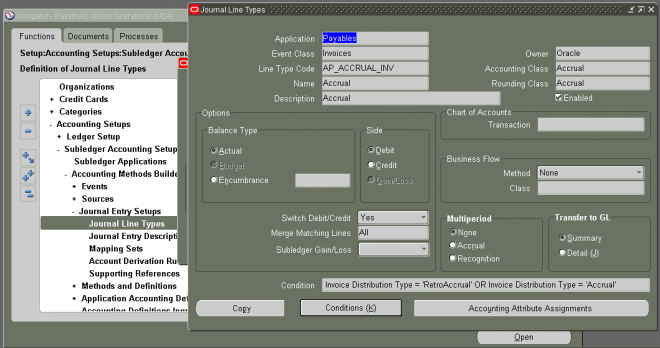

Application: Automatically populated with the application name associated with the user's responsibility.

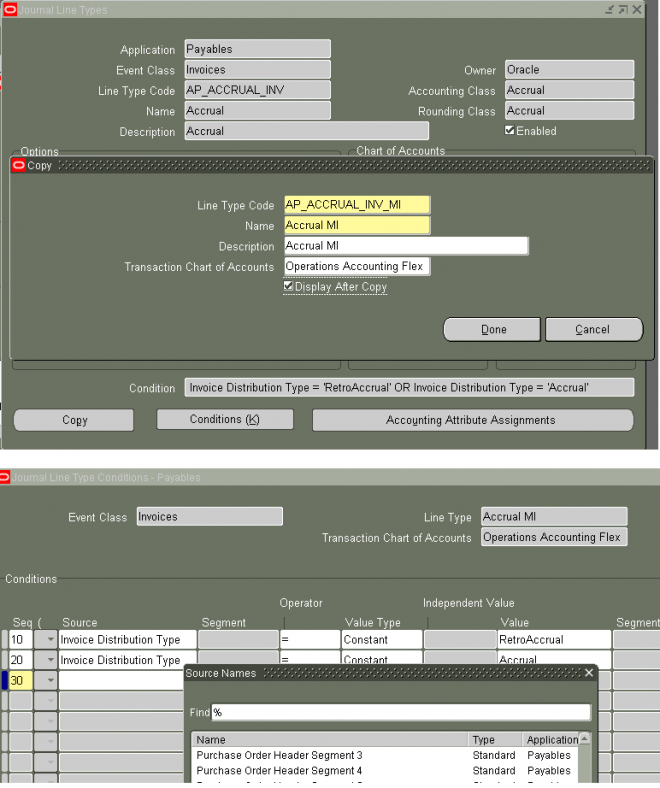

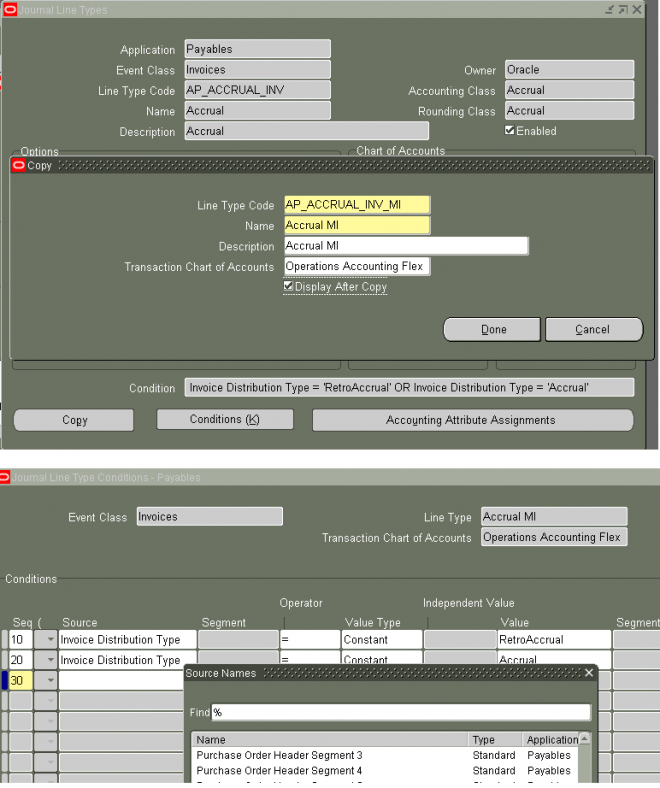

Line Type Code: Users cannot modify a seeded journal line type or any other seeded component as it could get overwritten in an upgrade. Instead users can copy the seeded type and then modify it appropriately. The copied journal line type has an Owner type of User.

The list of values displays the component name and the owner to distinguish between seeded and user-defined components.

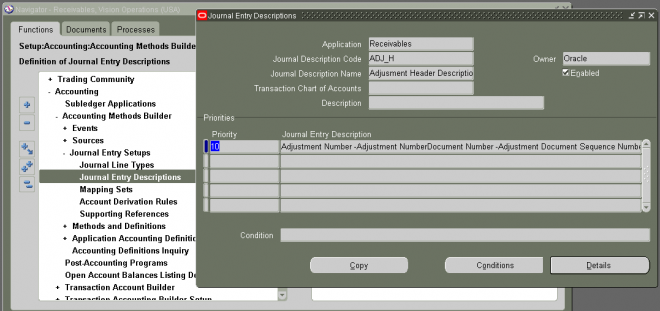

Name: Appears in the list of values when assigning the journal line type to a journal lines definition.

Accounting Class: Shared across applications and enables users to classify journal entry lines.

For example, when a receipt is matched to a purchase order and the accrual method is On Receipt, an accrual journal line is created upon receipt creation. When the Payables invoice is matched to a purchasing document, Payables creates a journal line reversing the original accrual. In this case, Purchasing and Payables define journal line types to generate these accruals and both of them can assign the accounting class Accrual.

Accounting classes are defined using an extensible AOL lookup type. The list of values for this field contains all accounting classes that are seeded but users can add new accounting classes.

Rounding Class: Defaults to the accounting class.

The rounding class, along with the transaction rounding reference accounting attribute, groups lines together in order to determine whether rounding is necessary.

Enabled: If selected, makes this journal line type available for use.

Encumbrance: If this balance type is selected and the business flow method is not Prior Entry, an encumbrance type must be selected from the drop-down list.

This field is disabled if Prior Entry is selected as the business flow method or if Accrual or Recognition is selected as the Multiperiod option.

Side: A Gain/Loss journal line type creates a debit line for a loss and a credit line for a gain. The gain/loss side journal line type is used exclusively for the gain or loss amount automatically calculated by Subledger Accounting and can only be defined for the actual balance type.

Note: For journal line types with a side of Gain/Loss, the following accounting attributes are not displayed in the Accounting Attributes Assignments window when accessed from this window:

Applied to Application ID, Applied to Distribution Type, Applied to Entity Code, Applied to First Distribution Identifier,

Applied to First System Transaction Identifier, Multiperiod End Date, Multiperiod Option, Multiperiod Start Date, Conversion Date,

Conversion Rate, Conversion Rate Type, Entered Amount, Entered Currency Code

Note: If the business flow method Prior Entry or Same Entry is selected, the Gain/Loss option cannot be selected.

The Gain/Loss option can only be selected if the business flow method is set to None and the Multiperiod option is also set to None.

Switch Debit/Credit: Determines whether negative amounts will result in negative amounts on the same side or positive amounts on the opposite side.

Note: If the Side is Gain/Loss, the Switch Debit/Credit field is disabled.

Merge Matching Lines: Summarizes subledger journal lines within each subledger entry. Journal entry lines with matching criteria are merged.

The possible values are:

All: All matching lines within a subledger journal entry with the same values for the following attributes:

Accounting Class, Rounding Class, Transaction Rounding Reference, Switch Side flag, Gain or Loss flag, Business Flow Class code

Multiperiod Option, Currency, Conversion Rate Type, Conversion Date, Conversion Rate, Third Party, Third Party Site, Third Party Type

Accounting Flexfield, Description, Reconciliation Reference, Gain/Loss Reference, Encumbrance Type

As a result of merging, a journal entry line with a net of zero amount can be created.

Note: that choosing All only merges all lines within a given subledger journal entry. This does not impact the transfer to General Ledger of summarized data. The latter is decided by making a choice in the Transfer to General Ledger region.

No: Matching lines are not merged.

Dr/Cr: Matching lines with the same debit or credit side are merged to produce a single debit or credit line when the attributes listed above are matching across debit or credit lines.

Note: Normally, users merge matching lines. However there are some exceptions. For example, in Italy, gain or loss amounts must be recorded for each invoice payment rather than at the total payment level. By setting the merge selection to No, users guarantee that journal entry lines are not merged, even though they are for the same transaction and entry.

Subledger Gain or Loss: Yes indicates that gain/loss is calculated in the primary ledger. The gain/loss amount is therefore not converted to the reporting currency and non-valuation method secondary ledgers. Select No for Subledger Accounting to calculate the gain or loss.

Note: When Gain or Loss is set to Yes, multiperiod accounting is disabled.

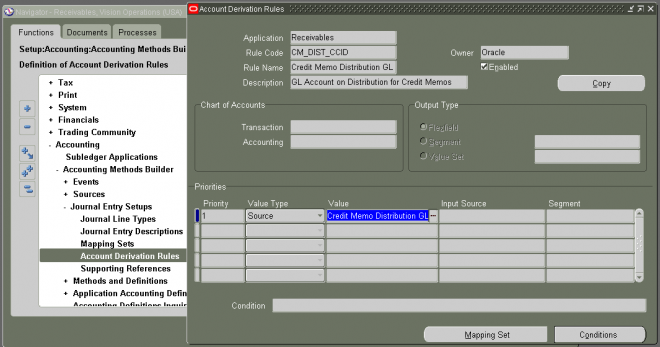

Transaction: Transaction chart of accounts.

Method: Business flow method

If Prior Entry or Same Entry is selected, the Gain/Loss option in the Side region cannot be selected.

If Prior Entry is selected, then the following accounting attributes are inherited from an upstream journal entry and cannot be selected or updated in the Accounting Attributes Assignments window:

Currency Code, Conversion Rate Type, Conversion Date, Conversion Rate, Party Type, Party Identifier, Party Site Identifier, Encumbrance Types

Class: Business flow class; required if the business flow method is Prior Entry

Multiperiod:

None: Journal line type will not create multiperiod accounting.

Accrual: To create the accrual journal line for the originating entry, such as prepaid expense

Recognition: To create the recognition journal line

Note: When Gain or Loss is set to Yes, multiperiod accounting is disabled and defaults to None.

Transfer to GL: Select Detail to maintain the same level of detail as the subledger journal entry line. Select Summary to summarize subledger journal entry lines by Accounting Flexfield.

One journal line is created in General Ledger to record the subledger activity.

Conditions: Opens the Journal Line Type Conditions window.

Accounting Attribute Assignments: This button is enabled when the conditions are entered.

Opens the Journal Line Accounting Attribute Assignments window.

When creating a journal line type, accounting attribute assignments are automatically established based on the default accounting attribute assignments for that journal line type's event class or entity. In the Journal Line Accounting Attribute Assignments window, override this default mapping of standard sources to accounting attributes. The list of values for the Source field contains all header level sources that are assigned by developers to the accounting attribute and event class associated with the journal line type. Users can assign a source to the Reconciliation Reference accounting attribute which is used to meet accounting requirements in continental Europe.