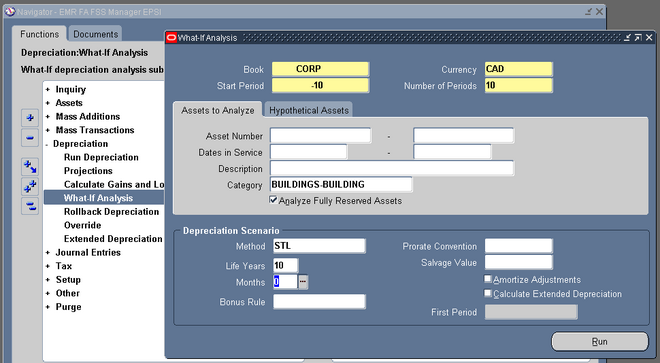

What-If Depreciation

You can use what-if depreciation analysis to forecast depreciation for groups of assets in different scenarios without making changes to your Oracle Assets data. You can run what-if depreciation analysis on assets defined in your Oracle Assets system or on hypothetical assets that are not defined in Oracle Assets.

Notes:

1. You may use What-if Analysis to project depreciation for a group asset. However, you may not create a hypothetical group asset.

2. Note that Prorate Convention has no relevance to group or member assets.

What-if depreciation analysis differs from depreciation projections in that what-if depreciation analysis allows you to forecast depreciation for many different scenarios without changing your Oracle Assets data. Depreciation projection allows projection only for the parameters set up in Oracle Assets.

To perform what-if depreciation analysis in Oracle Assets, you enter different combinations of parameters for a set of assets in the What-If Depreciation Analysis window. When you run what-if analysis based on the parameters you entered, Oracle Assets automatically launches a report, from which you can review the results of the analysis. You can run what-if analysis for as many scenarios as you like. Each time you run what-if analysis, Oracle Assets launches a separate report.

If you are satisfied with the results of your analysis, you can enter the new parameters in the Mass Changes window to update your assets according to the parameters you specified in the what-if analysis.

You may want to run what-if depreciation analysis for several different scenarios for comparison purposes. You can run what-if depreciation analysis for any number of scenarios. The results of an analysis will not overwrite the results of previous analyses.

Forecast depreciation using what-if depreciation analysis:

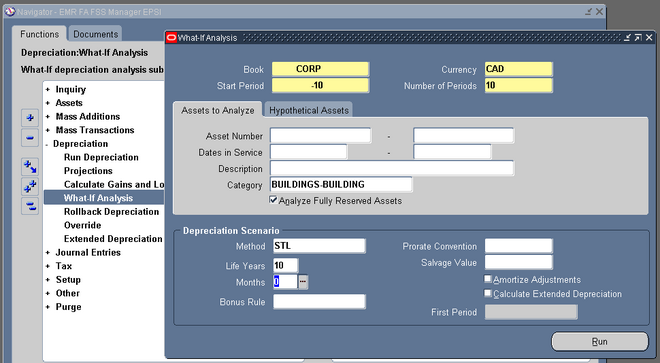

1. Navigate to the What-If Depreciation Analysis window in Oracle Assets.

2. The value in the Currency field defaults to the book's currency. If the book you chose is an MRC book, the Currency field defaults to the primary currency. If you want to run What-if Analysis for the reporting currency, change the value in the Currency field to the reporting currency.

3. Enter the starting period for which you want to run What-if Analysis.

4. Enter the number of periods for which you want to run What-if Analysis.

Note: You cannot run What-if Analysis for hypothetical assets in the reporting currency.

5. Enter the book containing the assets for which you want to run what-if analysis.

6. In the Assets to Analyze tabbed region, enter the parameters you want to use to identify the set of assets for which you want to run what-if depreciation analysis.

OR

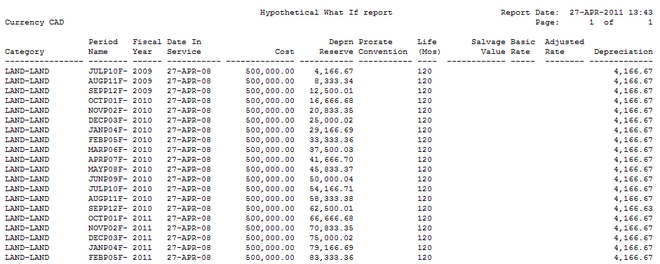

In the Hypothetical Assets tabbed region, enter the parameters to identify the hypothetical asset for which you want to run what-if depreciation analysis.

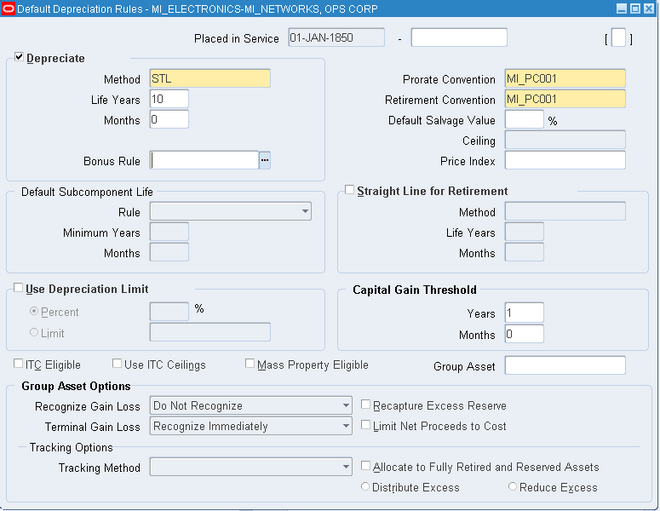

7. Enter the Depreciation Scenario parameters to identify the depreciation rules to be

used in the analysis.

8. Choose Run to run what-if depreciation analysis.

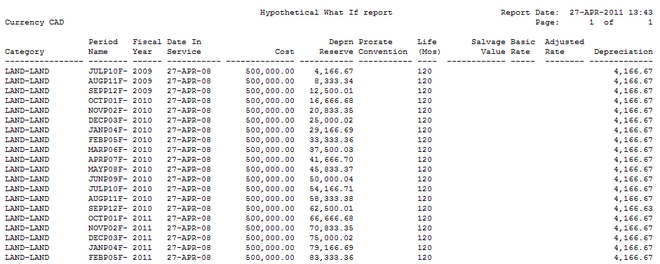

9. Review the results of the What-If Depreciation Report or the Hypothetical What-If Report by navigating to the View My Requests window.

10. Update your assets according to the specified parameters in the Mass Changes window.

OR

Repeat this procedure using different parameters.

Parameters

You run what-if depreciation analysis based on parameters you specify in the What-If Depreciation Analysis window in Oracle Assets. You enter these parameters for purposes of analysis only. The parameters you enter in these windows do not affect depreciation of your Oracle Assets data.

Assets to Analyze Parameters

Use the Assets to Analyze tabbed region when you want to perform what-if depreciation analysis on assets that exist in your Oracle Assets system. You use this group of parameters to tell Oracle Assets on which assets to perform what-if analysis. If you leave the optional fields blank, Oracle Assets defaults to performing analysis on all

possible assets.

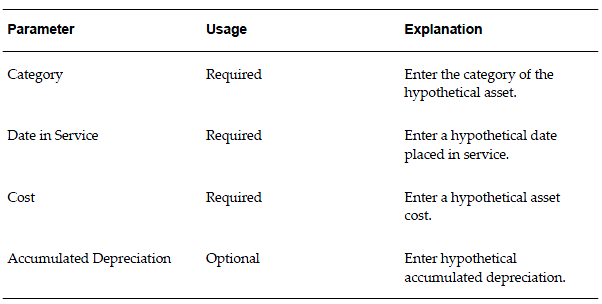

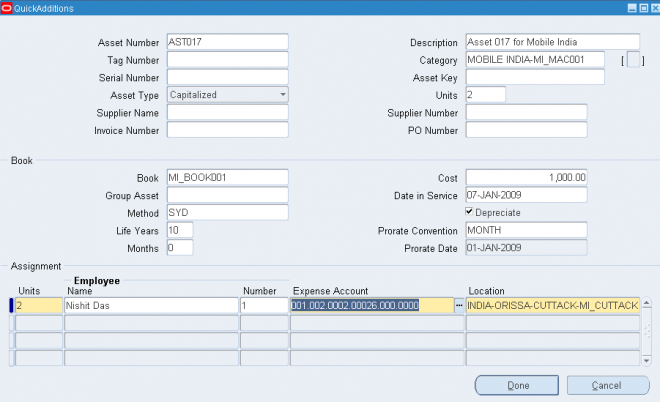

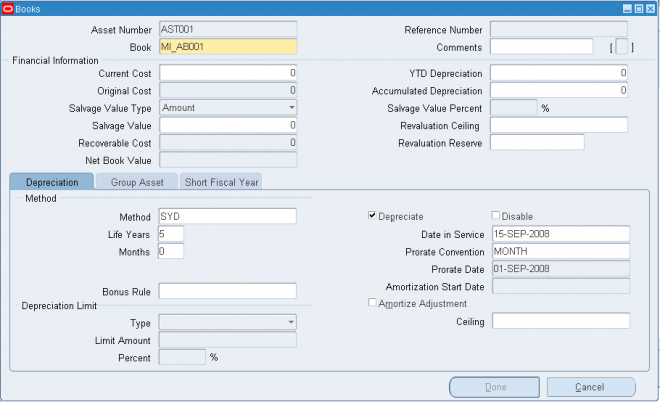

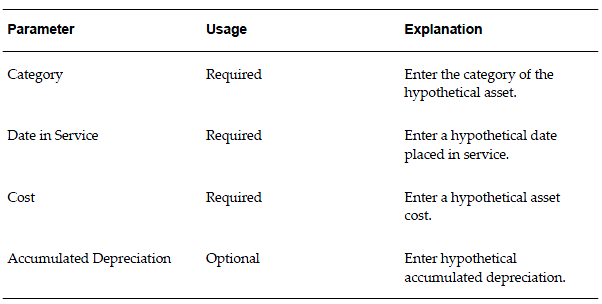

Hypothetical Assets Parameters

Use the Hypothetical Assets tabbed region when you want to perform what-if depreciation analysis on assets that have not been defined in your Oracle Assets system. The following table provides explanations of the parameters:

6.

6.

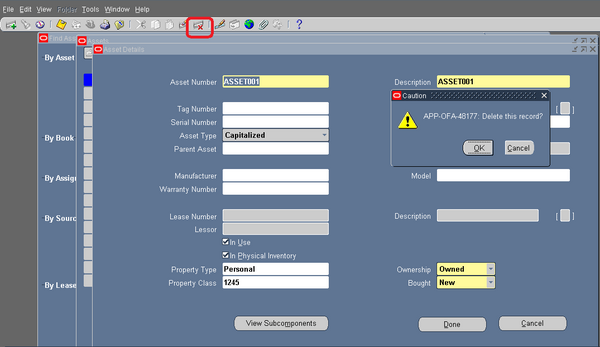

Deleted

Deleted