Prepayments

- A supplier might send an invoice that references a prepayment. If a supplier reduces the invoice amount by the amount of the prepayment and associated tax, you can use the Prepayment on Invoice feature to enter the invoice.

- You can enter two types of prepayments: Temporary and Permanent. Temporary prepayments can be applied to invoices or expense reports you receive. For example, you use a Temporary prepayment to pay a hotel a catering deposit. When the hotel's invoice arrives, apply the prepayment to the invoice to reduce the invoice amount you pay. Permanent prepayments cannot be applied to invoices. For example, you use a Permanent prepayment to pay a lease deposit for which you do not expect to be invoiced.

- The default ‘Settlement Date’ is calculated based on Prepayment Settlement Days Payables option. You can update this value.

- In the Invoice Workbench you can enter and apply prepayments. In the Quick Invoices window you cannot enter prepayments, but you can apply existing prepayments to invoices you enter.

You enter a prepayment as you enter any other invoice. However, you additionally specify 1) the prepayment type, Temporary or Permanent, and 2) the settlement date, the date after which the prepayment can be applied to an invoice. You can apply a hold to a prepayment if you want to control payment of it. You can also enter an invoice amount that includes a prepayment.

- On a prepayment, you can enter any number of distributions, either manually, or automatically by purchase order matching, distribution sets, or allocating. You can also take discounts on prepayments.

- You can apply paid Temporary prepayments on and after the prepayment settlement date. You can apply only Item distributions from the prepayment. The prepayment remains available until you apply the full amount of the prepayment Item distributions to one or more invoices. You can review the Prepayment Status Report to check the status of all prepayments in Payables.

- When you enter a Standard invoice in the Invoice Workbench, or enter an expense report in the Expense Reports window, Payables notifies you if you have available prepayments for the same supplier.

- You apply prepayments to invoices and expense reports differently, depending on where you enter them: Invoice Workbench, Quick Invoices, Expense Reports window, or Oracle Internet Expenses

To prevent payment of a prepayment, you can apply one or more holds to the prepayment or you can hold the scheduled payment. Apply these holds as you would for any other invoice.

You release holds from a prepayment just as you would for any other invoice.

Paying Prepayments

Pay a prepayment just as you would any other invoice. However, you cannot partially pay a prepayment; you must fully pay it.

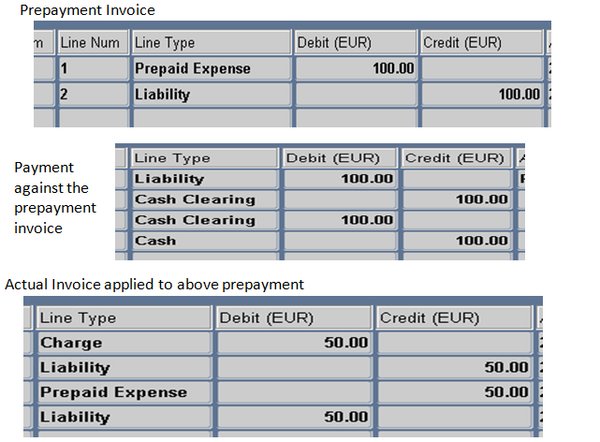

Accounting Entries

Prepaid Expense A/c Dr.

Supplier Liability A/C Cr.

When you enter a prepayment, Payables provides a default repayment account for each Item distribution. During prepayment entry, you can override the accounts Payables provides.Payables looks in the following order and uses the first valid prepayment account it finds: supplier site, supplier, Financials option.

However, if the prepayment is purchase order matched and if the Build Prepayment Accounts When Matching Payables option is enabled, then Payables builds each account for you and defaults the built account if it is a valid accounting combination.

2. When you receive the real invoice and enter with a charge account :

Invoice Charge (/AP Accrual) A/C Dr.

Supplier Liability A/C Cr.

When Prepayment is applied to an invoice(INV1) : Supplier Liability A/C Dr.

Prepayment A/C Cr.

So the final account entries are Charge A/C Dr

Supplier Liability Cr

So the final account entries are Charge A/C Dr

Supplier Liability Cr

Its simple1. Create a

Its simple

1. Create a prepayemnt invoice, validate, account it (Prepayment Liability1)

2. Pay the prepayment invoice. (Liability Cash)

3. Create an invoice in distribution enter the charge a/c.

4. Match the invoice to a pre payement. System 'll copy the prepyament accoun to the invoice distribution with negative amount.

Validate and account the invoice (Charge Liability

Liability1 Prepayment)