Returns & Debit Memo

Purchasing allows you to perform returns to suppliers and returns to customers in the Receiving Returns window. Use the Receiving Returns window to return delivered items to receiving and to return received or delivered externally sourced items to the supplier if the purchase order has

neither been cancelled nor final closed. If the Quality module is installed, you can enter quality information.

Use the Receiving Returns window to return items back to a customer. For example, a

customer returns to your company a part that does not work properly. You receive and fix the part, then return the part to the customer.

- You cannot enter returns for internal shipments.

- RMAs cannot be returned to the customer if the material has been delivered to Inventory.

- You can return to the supplier or customer unordered receipts that have not been matched

To return items to receiving, enter the return quantity in the Receiving Returns window. If you originally performed a direct receipt, you must specify a Return To receiving location. Otherwise, Purchasing routes all returned items to the receiving location from which you delivered them. For Inventory (but not Expense or Shop Floor) deliveries, you can update the Return From subinventory. You can also optionally specify additional return information such as Reason Code and RMA number (the number your supplier issues to you to track your return to the supplier).

To return items to the supplier or customer, enter the return quantity in the Receiving Returns window. Purchasing provides the source supplier or customer for the items.

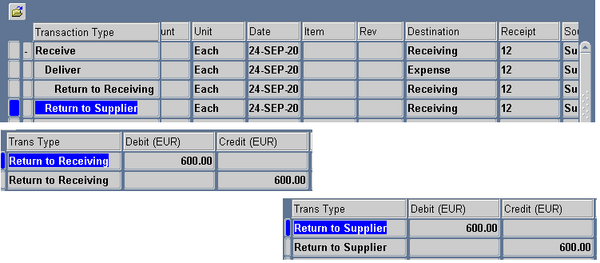

For Inventory (but not Expense or Shop Floor) deliveries, you can update the Return From subinventory. You can also optionally specify additional return information such as Reason Code and RMA number (the number your supplier issues to you to track your return to the supplier). When you return items to the supplier or customer, Purchasing creates both a Return To Receiving and a Return To Supplier transaction.

Purchasing also reopens the associated purchase order for the return quantity by reducing the original receipt quantity. For customer returns, if you return the item back to the customer, Purchasing updates the RMA to reflect the returned quantity.

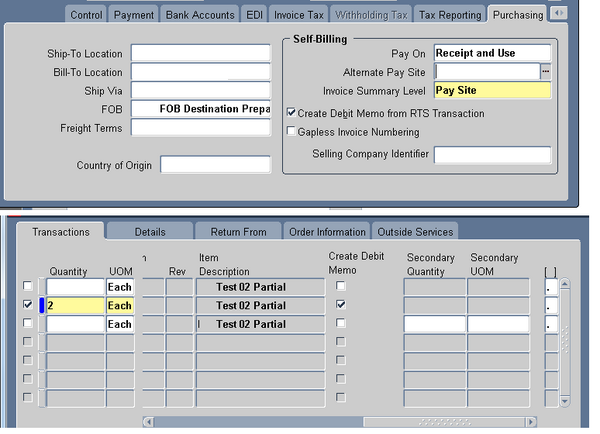

You can automatically generate debit memos for Return To Supplier transactions once an invoice has been created. When you create the return make sure the Create Debit Memo option is selected. To enable this functionality, enable the supplier site as a Pay Site (or indicate an Alternate Pay Site) and select Create Debit Memo from RTS Transaction in the Supplier Sites window

To To auto create debit memo from RTS, enable the supplier site as a Pay Site (or indicate an Alternate Pay Site) and select Create Debit Memo from RTS Transaction in the Supplier Sites window.When you create the return, make sure the Create Debit Memo Option is selected in the Returns window. Once you enable this functionality, a debit memo is created for each return line you enter in the Returns

To To auto create debit memo from RTS, enable the supplier site as a Pay Site (or indicate an Alternate Pay Site) and select Create Debit Memo from RTS Transaction in the Supplier Sites window.When you create the return, make sure the Create Debit Memo Option is selected in the Returns window. Once you enable this functionality, a debit memo is created for each return line you enter in the Returns

window.

- The debit memo number contains the original receipt number. Self-Biiling Invoice numbering affects debit memos.

- The debit memo is generated by the system with the number (PO receipt number – Sequence). The description of the debit memo is always ‘’System Generated by 'Return to Supplier' Transaction’’. You don’t need to run any program (standard/Interface) for this process.

- The debit memo is dated with the return transaction date. If this date does not fall within an open period in Oracle Payables, the date defaults to the first open date available in Payables.

- The payment schedule on the debit memo is based on the purchase order payment terms (in the Terms and Conditions window) and the invoice terms defined in Payables.

- The debit memo is calculated by multiplying the returned quantity by the purchase order item unit price. If the purchase order is in a foreign currency, and you perform invoice matching to receipts, Purchasing uses the currency conversion rate at the time of receipt to calculate the unit price.

- The debit memo does not include tax and freight charges.

- If the unit of measure (UOM) on the return in the Returns window differs from the purchase order UOM, Purchasing restates the return quantity on the debit memo in terms of the purchase order UOM

- If an invoice has not yet been created for the receiving transaction or if Payment on Receipt already accounted for the return using the Aging Period functionality, a debit memo will not be created. Whenever a debit memo cannot be created, you will receive a notification in the Notifications Summary window.

Debit Memo Format

Significant and precious information!Thank you for giving me the best day of my life!