Events

An event is an entry assigned to a top task or project that generates revenue and/or billing activity, but is not directly related to any expenditure items.

An event is an entry assigned to a top task or project that generates revenue and/or billing activity, but is not directly related to any expenditure items.

Unlike labor costs or other billable expenses, a bonus your business receives for completing a project ahead of schedule is not attributable to any expenditure item. In these cases, you use an event, rather than an expenditure item, to account for a bonus or other sum of money.

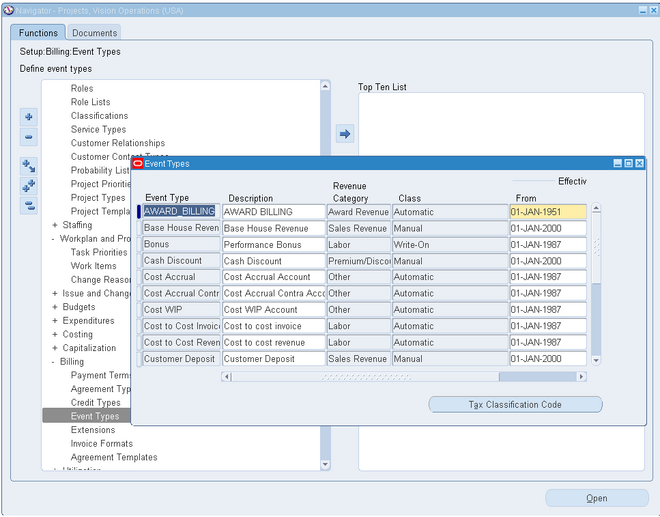

You classify events by event type. When you define an event type, you assign it one of the predefined classifications. When you enter an event, its event type classification determines how the event affects revenue and billing for a particular project.

You can define as many event types as you need, but you cannot create additional classifications.

Event Type. Enter a unique, descriptive name for this event type.

Revenue Category. Enter the revenue category that you want to associate with this event type.

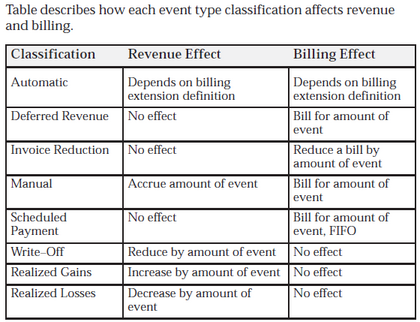

Class. Enter a classification for this event type to determine how an event affects the revenue and billing for a particular project. Oracle Projects provides you with the following classifications:

Automatic. An Automatic classification generates an automatic event for revenue or invoice amounts that may be positive or negative, depending on your implementation of billing

Deferred Revenue. A Deferred Revenue classification generates an invoice for the amount of the event, and has no immediate effect on revenue.

Invoice Reduction. An Invoice Reduction classification reduces the amount of an invoice without affecting revenue. For example, you can use an invoice reduction event to give a discount to a customer on a particular invoice.

Manual. A Manual classification allows you to enter both a revenue amount and a bill amount. These two amounts can be different. Classify an event type as manual when you need to indicate different revenue and bill amounts.

Scheduled Payment. A Scheduled Payment classification generates an invoice for the amount of the event. Oracle Projects marks expenditure items on the project being invoiced on a first–in first–out (FIFO) basis up to the amount of the event. When you use this classification, you can show details on an invoice even though the details are not used to calculate the bill amount.

Attention: The Scheduled Payment classification may be used only if the project uses Event based billing.

Write–On. A Write–On classification causes revenue to accrue for the amount of the write–on. A Write–On also adds the write–on amount to the subsequent invoice. Revenue and invoice amounts are identical. For example, when your business earns a bonus for completing a project on time or under budget, you can define an event type with the Write–On classification to account for the bonus amount. A write–on causes revenue to accrue and generates an invoice to bill your client for the bonus amount.

Write–Off. A Write–Off classification reduces revenue by the amount of the write–off.

Realized Gains A Realized Gain classification allows you to create an event to support reclassification of realized gains during funding revaluation.

Realized Loss A Realized Loss classification allows you to create an event to support reclassification of realized losses during funding revaluation

what PRC: Draft Revenue For a Single Project will exactly do

I have a query. I need to generate the events(class ->'Automatic') and the revenue amount through billing extension. Consider i am generating the revenue amount and the events(class ->'Automatic')through billing extension(achieved the event generation by using the PA_BILLING_PUB.INSERT_EVENT API) for a project. My Question is what the PRC: Generate Draft Revenue For a Single Project will do exactly, if i run it multiple times for a same project? Will it creates new event lines(for one top task) for each revenue run or it will delete the existing event and create a new event line for every revenue run(it is a unreleased draft revenue). Please provide me the answer ASAP. Thanks in advance, Jana